UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | [X] | Filed by a Party other than the Registrant | [ ] |

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

RAND CAPITAL CORPORATION

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies:

| |

| (2) | Aggregate number of securities to which transaction applies:

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |

| (4) | Proposed maximum aggregate value of transaction:

| |

| (5) | Total fee paid:

|

| [ ] | Fee paid previously with preliminary materials.

|

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid:

| |

| (2) | Form, Schedule or Registration Statement No.:

| |

| (3) | Filing party:

| |

| (4) | Date Filed:

|

Rand Capital Corporation

14 Lafayette Square, Suite 1405

Buffalo, New York 14203

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO OUR SHAREHOLDERS:

The 2021 Annual Meeting of Shareholders of Rand Capital Corporation (the “Corporation”) will be held on Thursday, April 22, 2021 at 10:30 a.m., local time, virtually via the internet at www.virtualshareholdermeeting.com/RAND2021 and in person at the offices of Hodgson Russ LLP, The Guaranty Building, 140 Pearl Street, Buffalo, New York 14202, to consider and vote on the following proposals:

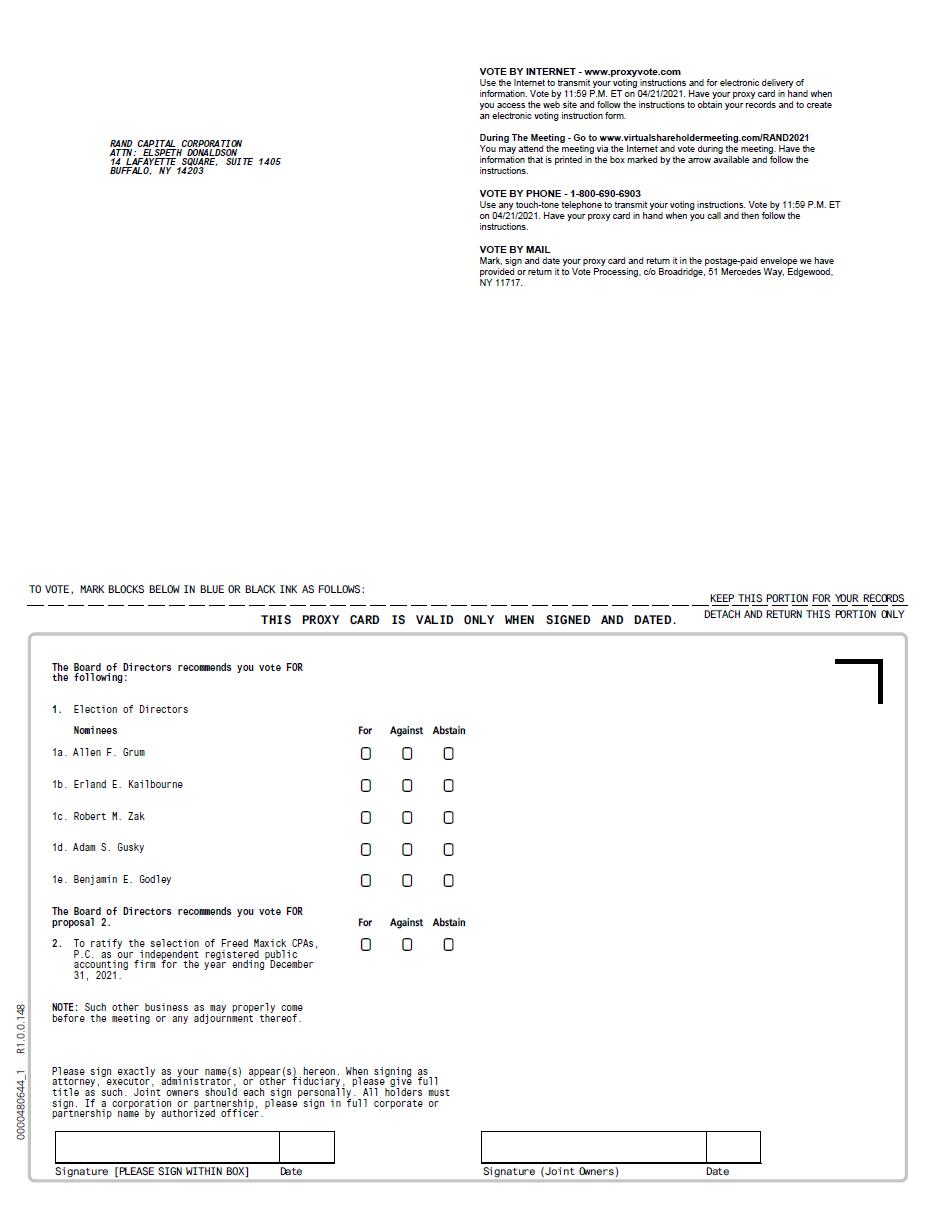

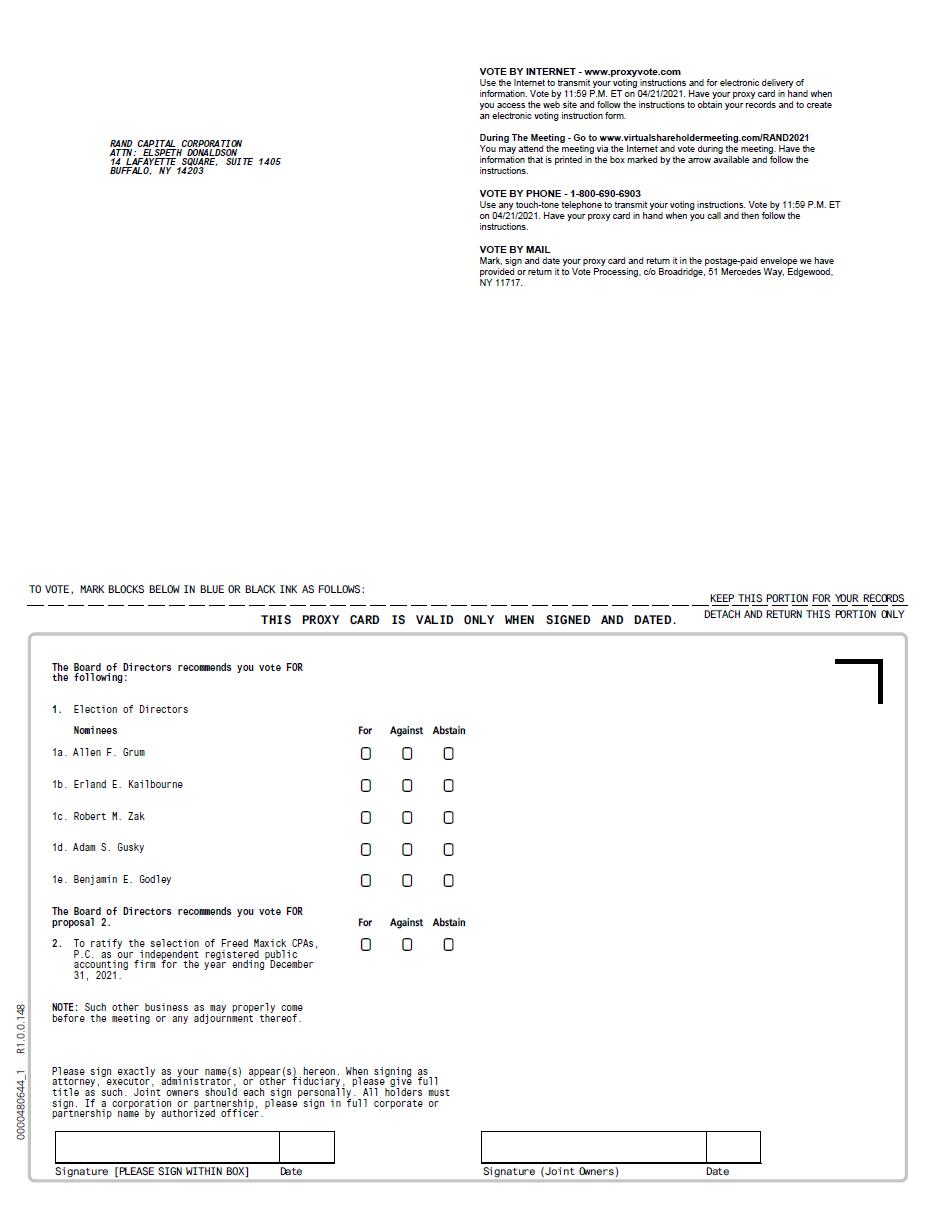

| 1. | To elect five Directors to hold office until the next annual meeting of shareholders and until their successors have been elected and qualified. | |

| 2. | To ratify the selection of Freed Maxick CPAs, P.C. as our independent registered public accounting firm for the year ending December 31, 2021. | |

| 3. | To consider and act upon such other business as may properly come before the meeting. |

Shareholders of record at the close of business on March 5, 2021 are entitled to notice of, and to vote at the annual meeting, and any adjournment thereof.

While the Corporation has scheduled, at this time, an in-person location for the Annual Meeting, the Corporation is sensitive to the public health and travel concerns its shareholders may have in light of the COVID-19 pandemic. As a result, the Corporation strongly encourages shareholders to attend the Annual Meeting remotely by visiting www.virtualshareholdermeeting.com/RAND2021. By attending the meeting virtually or in person, you will be able to participate in the Annual Meeting, including by voting at the Annual Meeting and submitting questions to be answered at the Annual Meeting.

As of March 5, 2021, the requirement under New York Business Corporation Law to hold an in-person meeting has been suspended through March 28, 2021 by an act of the New York State Legislature and an executive order by the Governor of the State of New York. If the suspension of the in-person meeting requirement is extended by an executive order of the Governor through the date of the Annual Meeting, the Corporation intends to hold the Annual Meeting as a virtual meeting only with no in-person location. In such case, the Corporation will announce the decision to do so at least one week in advance of the Annual Meeting, by press release, in a filing with the U.S. Securities and Exchange Commission, and on the Corporation’s website at www.randcapital.com. The Corporation strongly encourages you to check this website prior to the Annual Meeting. Note that any decision to proceed with a virtual-only Annual Meeting does not mean that the Corporation will use a virtual-only format or any means of remote communication for future meetings.

| March 17, 2021 | By order of the Board of Directors, |

| Buffalo, New York | |

| /s/ Daniel P. Penberthy | |

| Daniel P. Penberthy | |

| Executive Vice President, Chief Financial Officer and | |

| Secretary |

IMPORTANT NOTICE REGARDING

INTERNET AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING TO BE HELD ON

APRIL 22, 2021

THE PROXY STATEMENT AND ANNUAL REPORT TO SHAREHOLDERS

IS AVAILABLE AT: www.proxyvote.com

| Proxy 1 |

Rand Capital Corporation

14 Lafayette Square, Suite 1405

Buffalo, New York 14203

Proxy Statement

GENERAL INFORMATION

We are furnishing this Proxy Statement in connection with the solicitation of proxies by the Board of Directors of Rand Capital Corporation (“Rand” or the “Corporation” or “we”) for the Annual Meeting of Shareholders to be held on April 22, 2021 (“Annual Meeting”) at 10:30 a.m., local time.

This Proxy Statement and accompanying form of proxy are first being mailed to shareholders on or about March 17, 2021. A copy of Rand’s annual report, which contains Rand’s financial statements accompanies this Proxy Statement.

Due to public health concerns related to the COVID-19 pandemic and to support the health and well-being of our shareholders, services providers, personnel and other stakeholders, the Annual Meeting will be held virtually via the internet at www.virtualshareholdermeeting.com/RAND2021 and in person at the offices of Hodgson Russ LLP, The Guaranty Building, 140 Pearl Street, Buffalo, New York 14202. Due to the impact of the COVID-19 pandemic, the Corporation strongly encourages all shareholders to attend the meeting virtually using the remote access option.

As of March 5, 2021, the requirement under the New York Business Corporation Law (the “BCL”) to hold an in-person meeting has been suspended through March 28, 2021 by an act of the New York State Legislature and an executive order by the Governor of the State of New York. If the suspension of the in-person meeting requirement is extended by an executive order of the Governor through the date of the Annual Meeting, the Corporation intends to hold the Annual Meeting as a virtual meeting only with no in-person location. In such case, the Corporation will announce the decision to do so at least one week in advance of the Annual Meeting, by press release, in a filing with the U.S. Securities and Exchange Commission, and on the Corporation’s website at www.randcapital.com. The Corporation strongly encourages you to check this website prior to the Annual Meeting. Note that any decision to proceed with a virtual-only Annual Meeting does not mean that the Corporation will use a virtual-only format or any means of remote communication for future meetings.

Only shareholders of record at the close of business on March 5, 2021 (“Record Date”) are entitled to notice of and to vote at the Annual Meeting, and at any adjournment thereof. On the Record Date, Rand had 2,582,169 shares of common stock, par value $.10 per share (“shares”), issued, outstanding and entitled to vote at the Annual Meeting.

Each share entitles the holder to one vote. Shares cannot be voted at the Annual Meeting unless the shareholder is present or represented by proxy. If the enclosed form of proxy is returned properly executed and dated, the shares represented thereby will be voted at the Annual Meeting in accordance with the instructions contained in the proxy, unless the proxy is revoked prior to its exercise or a subsequently dated proxy is executed and submitted. If you authorize a proxy without indicating your voting instructions, the proxyholder will vote your shares “FOR” each of the directors standing for reelection in Proposal 1 and “FOR” Proposal 2 (Ratification of the Appointment of the Independent Registered Public Accounting Firm).

| Proxy 2 |

Any shareholder may revoke a proxy by executing a subsequently dated proxy or a notice of revocation, provided that the subsequent proxy or notice is delivered to the Corporation prior to the taking of a vote, or by voting in person or virtually at the Annual Meeting. If you hold shares through a broker, bank or other nominee, you must follow the instructions you receive from them in order to revoke your voting instructions. Attending the Annual Meeting does not revoke your proxy unless you also vote in person or virtually at the Annual Meeting.

Under the BCL and our by-laws, the presence, in person or by proxy, of the holders of a majority of the outstanding shares entitled to vote at the Annual Meeting is necessary to constitute a quorum of the shareholders to take action at the Annual Meeting. The shares that are present at the Annual Meeting or represented by a proxy will be counted for quorum purposes. Proxies submitted with abstentions and broker non-votes will be counted in determining whether or not a quorum is present. Under the BCL and the Corporation’s by-laws, once a quorum is established, Directors standing for election are to be elected by a plurality of the votes cast, and Proposal 2 (ratification of the appointment of the independent registered public accounting firm) is to be approved by a majority of votes cast in favor of the matter. Votes withheld, broker non-votes, and abstentions will not be counted as votes cast on any matter and will have no effect on the results of the vote. A broker non-vote occurs when a bank, broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power for that particular item and has not received instructions on how to vote from the beneficial owner. Brokers, banks and other nominees have discretionary authority to vote on “routine” matters, but not on “non-routine” matters. Proposal 1 (Election of Directors) is considered a non-routine matter, whereas Proposal 2 (Ratification of the Appointment of the Independent Registered Public Accounting Firm) is a routine matter. If you hold your shares in street name (or “nominee name”) and do not provide your broker, bank or other nominee who holds such shares of record with specific instructions regarding how to vote on Proposal 1, your bank, broker or other nominee may not be permitted to vote your shares on this Proposal 1. Please instruct your broker, bank or other nominee so your vote can be counted.

We will bear all costs of soliciting proxies for the Annual Meeting. We may pay brokers, nominees, fiduciaries and other custodians their reasonable fees and expenses for sending proxy materials to beneficial owners and obtaining their instructions. In addition to solicitation by mail, our Directors, our officers and the employees of Rand Capital Management LLC, the Corporation’s external investment adviser (“RCM”), may solicit proxies in person or by telephone, and they will receive no additional compensation therefor.

Our office is located at 14 Lafayette Square, Suite 1405, Buffalo, New York 14203 and our telephone number is 716-853-0802.

EXPLANATORY NOTE REGARDING THE EXTERNALIZATION

On November 8, 2019, the Corporation entered into an investment advisory and management agreement (the “Prior Advisory Agreement”) and an administration agreement (the “Prior Administration Agreement”) with RCM whereby RCM agreed to provide investment advisory and management services to the Corporation (the “Externalization”). Following the Externalization, all of the Corporation’s employees, including its executive officers, became employees of RCM and no longer receive any direct compensation from the Corporation. The Corporation’s day-to-day investment operations are managed by RCM and services necessary for its business, including the origination and administration of its investment portfolio, are provided by individuals who are employees of RCM.

| Proxy 3 |

Subsequently, in late 2020, the Corporation’s Board of Directors (the “Board”) was advised by RCM that Callodine Group, LLC (“Callodine”), an entity controlled by James Morrow, intended to acquire a controlling interest in RCM, which was then-currently majority owned by East Asset Management, LLC (“East”). Section 15(a) of the Investment Company Act of 1940, as amended (the “1940 Act”) provides that any investment management contract, such as the Prior Advisory Agreement, terminates automatically upon on its “assignment.” Section 2(a)(4) of the 1940 Act provides that the transfer of a controlling interest of an investment adviser, such as was to be caused by East’s transfer of its controlling interest in RCM to Callodine (the “Adviser Change in Control”), constitutes an “assignment.” As a result of the proposed Adviser Change in Control, the Corporation’s shareholders were asked to approve a new investment advisory and management agreement (the “New Advisory Agreement”) with RCM at a special meeting of shareholders held on December 16, 2020 (the “Special Meeting”). The terms of the New Advisory Agreement were identical to those contained in the Prior Advisory Agreement, with RCM continuing to provide investment advisory and management services to the Corporation following the Adviser Change in Control. Following approval by the Corporation’s shareholders at the Special Meeting, the Corporation, on December 31, 2020, entered into the New Advisory Agreement and a new administration agreement (the “New Administration Agreement”) with RCM.

As a result of the foregoing, RCM currently acts as the Corporation’s investment adviser and administrator pursuant to the terms of the New Advisory Agreement and the New Administration Agreement. As described in greater detail in the Corporation’s Annual Report on Form 10-K under Part I, Item 1 “Business ‒ Investment Advisory and Management Agreement,” the compensation paid by the Corporation to RCM for providing investment advisory and management services under the New Advisory Agreement consists of two components — (i) a base management fee and (ii) an incentive fee consisting of two parts: (A) an income based fee and (B) a capital gain based fee. In addition, the Corporation reimburses RCM for the Corporation’s allocable portion of expenses incurred by RCM in performing administrative obligations and functions for the Corporation under the New Administration Agreement. The address of RCM is 14 Lafayette Square, Suite 1405, Buffalo, New York 14203.

VIRTUAL MEETING INFORMATION

Due to public health concerns related to the COVID-19 pandemic and to support the health and well-being of our shareholders, services providers, personnel and other stakeholders, the Corporation is providing shareholders with the option to attend the Annual Meeting virtually via the internet at www.virtualshareholdermeeting.com/RAND2021. The Corporation strongly encourages all shareholders to attend the meeting virtually using the remote access option.

As of March 5, 2021, the requirement under the BCL to hold an in-person meeting has been suspended through March 28, 2021 by an act of the New York State Legislature and an executive order by the Governor of the State of New York. If the suspension of the in-person meeting requirement is extended by an executive order of the Governor through the date of the Annual Meeting, the Corporation intends to hold the Annual Meeting as a virtual meeting only with no in-person location. In such case, the Corporation will announce the decision to do so at least one week in advance of the Annual Meeting, by press release, in a filing with the U.S. Securities and Exchange Commission, and on the Corporation’s website at www.randcapital.com. The Corporation strongly encourages you to check this website prior to the Annual Meeting. Note that any decision to proceed with a virtual-only Annual Meeting does not mean that the Corporation will utilize a virtual-only format or any means of remote communication for future meetings.

| Proxy 4 |

We have structured the virtual component of our Annual Meeting to provide shareholders with the same rights as if they participated in person, including the ability to vote shares electronically during the Annual Meeting and ask questions in accordance with the rules of conduct for the Annual Meeting.

To participate virtually in the Annual Meeting, you will need your 16-digit control number included in your proxy materials or voting instruction form. The Annual Meeting will begin promptly at 10:30 a.m., local time, on April 22, 2021. We recommend that you log in at least 15 minutes before the Annual Meeting begins to ensure ample time to complete the check-in procedures and test your computer audio system. If you encounter any difficulties accessing the virtual meeting platform during check-in or during the Annual Meeting, please call the technical support number that will be posted on the virtual meeting platform login page at www.virtualshareholdermeeting.com/RAND2021.

You can submit your questions by logging into www.virtualshareholdermeeting.com/RAND2021 with your 16-digit control number. Additional information regarding the rules and procedures for asking questions during the virtual component of the Annual Meeting will be provided in our rules of conduct, which shareholders can view on the virtual meeting platform.

You will also be permitted to vote through the virtual meeting platform using your 16-digit control number. If you hold your shares in a brokerage account or through a bank or another nominee, since you are not the shareholder of record, in order to vote these shares electronically at the Annual Meeting you must obtain and submit a legal proxy from your bank, broker or other nominee through the virtual meeting platform.

| Proxy 5 |

BENEFICIAL OWNERSHIP OF SHARES

Unless otherwise indicated, the following table sets forth beneficial ownership of our shares on March 5, 2021, by (a) persons known by us to be beneficial owners of more than 5% of the outstanding shares, (b) the Directors, nominees for Director, and the named executive officers of Rand, and (c) all Directors and executive officers as a group. For purposes of the table, the address for each of our Directors, nominees for Director and named executive officers is c/o 14 Lafayette Square, Suite 1405, Buffalo, NY 14203. Unless otherwise stated, each person named in the table has sole voting and investment power with respect to the shares indicated as beneficially owned by that person.

| Amount and Nature of | Percent | |||||||

| Beneficial Owner | Beneficial Ownership (1) | of Class (5) | ||||||

| (a) More than 5% Owners: | ||||||||

| East Asset Management, LLC | 1,641,640 | 63.6 | % | |||||

| 7777 NW Beacon Square Blvd. | ||||||||

| Boca Raton, FL 33487 | ||||||||

| User-Friendly Phone Book, LLC | 202,991 | 7.9 | % | |||||

| 10200 Grogan’s Mill Road, Suite 440 | ||||||||

| The Woodlands, TX 77380 | ||||||||

| (b) Directors, nominees for Director and named executive officers: | ||||||||

| Benjamin E. Godley | 18,394 | * | ||||||

| Allen F. Grum | 33,608 | 1.3 | % | |||||

| Adam S. Gusky (2) | 1,646,881 | 63.8 | % | |||||

| Erland E. Kailbourne (3) | 6,468 | * | ||||||

| Robert M. Zak | 16,409 | * | ||||||

| Daniel P. Penberthy | 15,269 | * | ||||||

| * Less than 1%. | ||||||||

| (c) All Directors and executive officers as a group | ||||||||

| (six persons) (4) | 1,737,029 | 67.3 | % | |||||

(1) The beneficial ownership information presented is based upon information furnished by each person or contained in filings made with the Securities and Exchange Commission (“SEC”).

(2) This amount includes 5,421 shares held by AG Energy, LLC, which may be deemed to be beneficially owned by Mr. Gusky by virtue of his control of AG Energy, LLC. In addition, Mr. Gusky is the Chief Investment Officer of East and may be deemed to have beneficial ownership of the shares held directly by East by virtue of his position with East. Mr. Gusky disclaims beneficial ownership of the shares held by East.

(3) This amount includes 139 shares owned by Mr. Kailbourne’s spouse.

(4) Except as noted in footnotes 2 and 3 above with respect to Mr. Gusky and Mr. Kailbourne, respectively, members of the group have sole voting and investment power over their respective shares.

(5) Percent of Class calculated based on 2,582,169 shares issued and outstanding at the Record Date.

| Proxy 6 |

PROPOSAL 1. ELECTION OF DIRECTORS

Five Directors are to be elected at the Annual Meeting. The five nominees were each elected at the last annual meeting of shareholders held in April 2020. Messrs. Gusky and Godley were each designated for nomination for election to the Board by East pursuant to the terms of that certain shareholder agreement, dated as of November 8, 2019, by and between Rand and East (the “Shareholder Agreement”). For additional information on the terms of the Shareholder Agreement with East, see the description included in “Nomination of Directors” below.

Each of the nominees, including Messrs. Gusky and Godley that were designated for nomination by East under the terms of the Shareholder Agreement, was recommended for nomination for election by the Governance and Nominating Committee, which is comprised solely of Independent Directors. Each of the nominees has consented to serve as a Director if elected. If at the time of the Annual Meeting any nominee should be unable to serve, it is the intention of the persons designated as proxies to vote, in their discretion, for such other person as may be designated as a nominee by the Board.

Director Independence

The Board of Directors has affirmatively determined that the following current non-employee Directors are “Independent Directors” under the rules of the SEC and under the rules and guidelines of the Nasdaq Stock Market: Benjamin E. Godley, Erland E. Kailbourne and Robert M. Zak. The Board applies the standards of the SEC and the rules and guidelines of the Nasdaq Stock Market to assist it in making independence determinations. The Board considers all relevant facts and circumstances in determining whether a material relationship between Rand and a director exists that would interfere with that director’s exercise of independent judgment in carrying out their responsibilities as a director. In making this determination, the Board considered the analysis and recommendations of the Governance and Nominating Committee, as well as any related person transactions and other relationships with the Corporation. Material relationships that the Board may consider include commercial, consulting, legal, accounting, industrial, charitable and family relationships.

The nominees for election as a Director at the Annual Meeting have been nominated by the Independent Directors of the Board upon the recommendation of Rand’s Governance and Nominating Committee, which is comprised solely of Independent Directors in compliance with the requirements of Nasdaq Listing Rule 5605(e)(1).

Allen F. Grum and Adam S. Gusky have each been determined to be an “interested person” under Section 2(a)(19) of the 1940 Act with respect to Rand. Directors who are determined to be interested persons do not qualify as Independent Directors under the rules and guidelines of the Nasdaq Stock Market.

The Board of Directors, with reference to the SEC rules and the Nasdaq Stock Market rules and guidelines, also determined that:

| ● | each member that served on the Audit Committee and the Governance and Nominating Committee during 2020 was independent under the applicable Nasdaq Stock Market rules and guidelines and SEC rules for purposes of determining independence of the members of each of those committees; and | |

| ● | each member that served on the Audit Committee during 2020 also met the additional independence requirements under Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Nasdaq Listing Rule 5605(c)(2)(A). |

| Proxy 7 |

Rand’s Board Chair, Mr. Kailbourne, served as chair of the “executive sessions” of the Independent Directors of the Board during 2020. These “executive sessions” occurred at least twice during 2020. The Corporation also held separate committee meetings of the Board during 2020, which committees were comprised solely of Independent Directors.

Board Leadership Structure

Erland E. Kailbourne has served as Board Chair of the Board of Directors of the Corporation since 2018 and is not an “interested person” under Section 2(a)(19) of the 1940 Act with respect to Rand. His long-standing business experience is important to the Board’s discussions. Robert M. Zak was appointed Vice Chair on November 5, 2014 and is also not an “interested person” under Section 2(a)(19) of the 1940 Act with respect to Rand. Allen F. Grum has served as President and Chief Executive Officer since 1996 and qualifies as an “interested person” under Section 2(a)(19) of the 1940 Act with respect to Rand. The Corporation believes that separating the Board Chair and President (CEO) roles provides independent oversight of the Corporation, enhanced leadership by the Independent Directors, and a check on the executive officers of the Corporation, who are also employees of RCM.

The Board’s Role in Risk Oversight

The Board’s role in the Corporation’s risk oversight process consists of receiving regular reports from Rand’s executive officers and officers of RCM on areas of material risk to the Corporation, including portfolio valuation, operational, financial, legal, regulatory and compliance, strategic and reputational risks. The full Board (or the appropriate committee in the case of risks that are under the purview of a particular committee) reviews these reports from Rand’s executive officers and officers of RCM to understand and provide input on the management of these risks.

In addition, the Board also performs its risk oversight responsibilities with the assistance of the Corporation’s chief compliance officer and RCM’s chief compliance officer. The Board reviews written reports from the Corporation’s chief compliance officer and RCM’s chief compliance officer discussing the adequacy and effectiveness of the compliance policies and procedures of the Corporation, RCM and the Corporation’s other service providers. Annual reports provided by the Corporation’s chief compliance officer and RCM’s chief compliance officer address: (i) the operation of the compliance policies and procedures of the Corporation and RCM since the last report; (ii) any material changes to such policies and procedures since the last report; (iii) any recommendations for material changes to such policies and procedures as a result of an annual review; and (iv) any compliance matter that has occurred since the date of the last report about which the Board would reasonably need to know to oversee compliance.

Shareholder Communications

Communications to an individual Director, to non-employee Directors as a group, or to the entire Board, should be addressed as follows: Erland E. Kailbourne, Security Holder Board Communications, 14 Lafayette Square, Suite 1405, Buffalo, New York, 14203, with an indication of the individual or subgroup (if any) to whose attention the communication is directed. All security holder communications addressed in that manner will be delivered directly to Mr. Kailbourne, who will receive communications for the Board and non-employee Directors, and who will deliver the communication unopened to any individually indicated Director.

| Proxy 8 |

Meeting Attendance

Directors are expected to attend the Annual Meeting each year, but such attendance is not required. All of the Corporation’s directors attended the 2020 annual meeting of shareholders, which was held as a virtual meeting by means of remote communication due to the COVID-19 pandemic.

Information Regarding Directors, Nominees for Director, and Executive Officers

The following table provides information concerning all persons who are nominees for Director or executive officers of Rand.

Name, Age and Address |

Position(s) held with Fund | Length of Time Served as a Director(1) |

Business Experience and Occupations During Last Five Years | Other Director- ships (2) | ||||

| Directors who are Interested Persons | ||||||||

Allen F. Grum (3) (63) c/o 14 Lafayette Square, Suite 1405, Buffalo NY 14203 |

President and Chief Executive Officer of Rand and a Director | 1996 | President and Chief Executive Officer of the Corporation since 1996. In addition, Mr. Grum has served on the investment committee of RCM, which is the external investment adviser for the Corporation and responsible for all aspects of the Corporation’s investment process, and as the President and Chief Executive Officer of RCM since November 2019. Prior to his position as President and CEO of the Corporation, Mr. Grum served as Senior Vice President of the Corporation commencing in June 1995. Mr. Grum serves on a number of Boards of Directors of companies in which Rand Capital Corporation has an investment. His in-depth knowledge of Rand Capital Corporation’s and RCM’s operations, and the industries in which the Corporation operates makes Mr. Grum qualified to serve as a Director. | None | ||||

| Proxy 9 |

Adam S. Gusky (4) (46) c/o 14 Lafayette Square, Suite 1405, Buffalo NY 14203 |

Director | 2019 | Mr. Gusky has been the Chief Investment Officer of East since its inception in 2010 and has served as the Chief Investment Officer for East Resources Acquisition Company, a special purpose acquisition company, since its incorporation in May 2020. In addition, Mr. Gusky has served on the investment committee of RCM, which is the external investment adviser for the Corporation and responsible for all aspects of the Corporation’s investment process, since November 2019. Prior to joining East, Mr. Gusky worked for CNN/Sports Illustrated and o2 Wireless Solutions. Mr. Gusky earned both his Master of Business Administration (class of 2006) and his Bachelor of Arts degrees from Duke University (class of 1997). Mr. Gusky’s extensive knowledge of deal structuring and financing transactions obtained during his service as the Chief Investment Officer for East makes Mr. Gusky qualified to serve as a Director. | None | ||||

| Directors who are not Interested Persons | ||||||||

Benjamin E. Godley (57) c/o 14 Lafayette Square, Suite 1405, Buffalo NY 14203 |

Director | 2019 | Mr. Godley is the President of Greenough Communications, a marketing and public relations services firm. Previously, he was co-founder and CEO of Contributor Development Partnership (“CDP”), a public benefit corporation focused on improving the operational efficiency and revenue generation capacity of the public media system. Prior to becoming CEO of CDP, Mr. Godley was COO of WGBH (the largest producer of PBS content with annual revenue of $250m). Mr. Godley joined WGBH in 2008 as Executive Vice President, was named Chief Operating Officer in 2010, and was additionally named President of Business Services in 2017. Prior to joining WGBH, Mr. Godley served as Senior Advisor/Deputy National Finance Director on Mitt Romney’s 2008 presidential campaign, and a member of Governor Romney’s senior staff as Director of Governmental Affairs for the Commonwealth. Earlier in his career, Mr. Godley co-founded and was President and CEO of CGN Marketing & Creative Services and also held marketing and management roles at Hill & Knowlton and IBM. Mr. Godley’s significant business experience across a range of industries provides invaluable expertise as a Director of Rand. | None | ||||

| Proxy 10 |

Erland E. Kailbourne (79) c/o 14 Lafayette Square, Suite 1405, Buffalo, NY 14203 |

Director and Chairman of the Board | 1999 | Chairman of Albany International, Inc since 2020. Prior to that he was a Director of Albany International, Inc. since 1999 and previously served as its Chairman of the Board from May 2008 until February 2019. From January 2006 until May 2015, Mr. Kailbourne was a Director of Financial Institutions, Inc. and its subsidiary Five Star Bank. He retired as Chairman and Chief Executive Officer (New York Region) of Fleet National Bank, a banking subsidiary of Fleet Financial Group, Inc., in 1998. From 1995 to 2000, he was Vice Chairman State University of New York (SUNY). He was Chairman and Chief Executive Officer of Fleet Bank, also a subsidiary of Fleet Financial Group, Inc., from 1993 until its merger into Fleet National Bank in 1997. He is a Director of REV LNG Holdings, LLC, Allegany Co-op Insurance Company, Conemaugh Valley Insurance Company, and The Thomas and Laura Moogan Foundation. Mr. Kailbourne’s extensive banking and financial experience provide necessary attributes as a Director of Rand. | Director of Albany International, Inc. | ||||

Robert M. Zak (63) 250 Main Street Buffalo, NY 14202 |

Director and Vice Chair of the Board | 2005 | Since 1995, Mr. Zak has been President and Chief Executive Officer of Merchants Mutual Insurance Company, which operates under the trade name Merchants Insurance Group. Mr. Zak has announced his intention to retire as President and Chief Executive Officer of Merchants Mutual Insurance Company effective as of March 31, 2021. After his retirement, Mr. Zak will become the non-executive Chair of the Board of Merchants Mutual Insurance Company. Mr. Zak joined Merchants in 1985. Prior to that, his career was in public accounting. Mr. Zak served as a director of Manning & Napier, Inc. from November 2011 until June 2016. Mr. Zak’s executive leadership and public accounting experience provide desirable attributes as a Director of Rand. | None |

| Proxy 11 |

| Non-Director Executive Officers | ||||||||

Daniel P. Penberthy (3) (58) 14 Lafayette Square, Suite 1405, Buffalo, NY 14203 |

Executive Vice President, Treasurer and Chief Financial Officer of Rand | N/A | Mr. Penberthy has served as Treasurer of the Corporation since August 1997. Since January 2002, Mr. Penberthy has served as Executive Vice President of the Corporation, and he has continued to serve as the Chief Financial Officer of the Corporation since 1997. In addition, Mr. Penberthy has served on the investment committee of RCM, which is the external investment adviser for the Corporation and responsible for all aspects of the Corporation’s investment process, and as the Executive Vice President and Chief Financial Officer of RCM since November 2019. From 1993 to 1997, Mr. Penberthy served as Chief Financial Officer for both the Greater Buffalo Partnership (formerly the Chamber of Commerce) and the Greater Buffalo Convention and Visitors Bureau. Prior thereto, from 1990 to 1993, Mr. Penberthy was employed by Greater Buffalo Development Foundation and KPMG. | None | ||||

| (1) | Indicates initial year in which such person became a Director. All Directors’ terms of office will be through the next annual meeting of shareholders and until their successors have been duly elected and qualified. |

| (2) | Indicates directorships of companies with a class of equity securities registered under Section 12 of the Exchange Act, subject to the requirements of Section 15(d) of the Exchange Act, or registered as an investment company under the 1940 Act. |

| (3) | Deemed to be an interested person under Section 2(a)(19) of the 1940 Act due to their respective positions as an officer of the Corporation, an officer of RCM and a member of the RCM investment committee. |

| (4) | Deemed to be an interested person under Section 2(a)(19) of the 1940 Act due to his position as a director of the Corporation and a member of the RCM investment committee. |

The Board of Directors of the Corporation unanimously recommends a vote “FOR” the election of the nominees named in this Proxy Statement.

Approximate Value of Investments in Rand

The following table indicates the range of value as of March 5, 2021 of the shares of Rand (the “Fund”) beneficially owned by each Director and nominee for Director of Rand. Rand is not part of a “family of investment companies” as that term is defined in Schedule 14A under the Exchange Act.

| Dollar Range of Equity | ||

| Name of Director or Nominee | Securities in the Fund | |

| (a) Directors who are not Interested Persons: | ||

| Benjamin E. Godley | Over $100,000 | |

| Erland E. Kailbourne | Over $100,000 | |

| Robert M. Zak | Over $100,000 | |

| (b) Directors who are Interested Persons: | ||

| Adam S. Gusky | $50,000‒$100,000 | |

| Allen F. Grum | Over $100,000 |

| Proxy 12 |

COMMITTEES AND MEETING DATA

The Committees of the Board of Directors had the following members from January 1, 2020 through December 31, 2020:

| Governance and | ||

| Nominating Committee | Audit Committee | |

| Benjamin E. Godley (Chair) | Robert M. Zak (Chair) | |

| Robert M. Zak | Benjamin E. Godley | |

| Erland E. Kailbourne | Erland E. Kailbourne |

As described in greater detail below under “Compensation Committee,” upon the completion of the 2019 annual meeting of shareholders and after the Externalization, (i) consistent with the requirements of the Nasdaq Listing Rules given the Corporation’s status as a “controlled company” and (ii) given all of the Corporation’s employees, including its executive officers, became employees of RCM and no longer receive any direct compensation from the Corporation, the Board determined no longer to have an active Compensation Committee.

During 2020, the full Board met nine times, the Audit Committee met five times, and the Governance and Nominating Committee met two times. During 2020, each Director, other than Mr. Zak, attended 100% of the total number of meetings of the Board and of the committees of which such Director was a member. Mr. Zak was excused from one meeting of the Board, and therefore attended at least 75% of total number of meetings of the Board and of the committees of which Mr. Zak was a member.

Compensation Committee

As of the Record Date, East owns approximately 64.3% of our outstanding shares. As a result of East’s ownership percentage, the Corporation qualifies as a “controlled company” under Nasdaq Listing Rule 5615(c) and therefore is permitted to avail itself of the exemptions under the Nasdaq Listing Rules afforded to a “controlled company.” Pursuant to the Nasdaq Listing Rules, the Corporation, as a “controlled company,” is exempt from the requirements of Nasdaq Listing Rule 5605(d) regarding the need to have a standing and fully independent compensation committee. Given, upon the completion of the Externalization, the Corporation no longer has any employees and the employees of RCM do not receive any direct compensation from the Corporation, the Board determined after the completion of the 2019 annual meeting of shareholders that it was no longer necessary or useful to establish and retain a standing compensation committee. Any functions previously performed by the Compensation Committee that may still be applicable for the Corporation after the completion of the Externalization will now be performed by the Governance and Nominating Committee. Given the Board’s focus on good corporate governance, at this time, the Board has decided not to avail itself of any of the other exemptions that are permitted to be used by a “controlled company” under the Nasdaq Listing Rules.

| Proxy 13 |

Governance and Nominating Committee

The primary purposes of the Governance and Nominating Committee include:

| ● | developing, recommending to the Board and assessing corporate governance policies for Rand; | |

| ● | overseeing the evaluation of the Board and its committees; | |

| ● | reviewing and making recommendations to the full Board regarding the amount and type of compensation that is to be paid to the non-employee Directors; and | |

| ● | recommending to the Board individuals to be nominated by the Board for election by the Corporation’s shareholders at each annual meeting of shareholders, and recommending to the Board candidates to fill vacancies on the Board. |

The Governance and Nominating Committee’s charter may be accessed at Rand’s website, www.randcapital.com. None of the persons that served on the Governance and Nominating Committee during 2020 were “interested persons” as defined in Section 2(a)(19) of the 1940 Act. Each member of the Governance and Nominating Committee during 2020 met the independence requirements of the Nasdaq Stock Market.

Nomination of Directors

The Governance and Nominating Committee, as part of its responsibilities under its Charter, oversees the identification of qualified individuals to serve on the Board.

We seek Directors who have the required and appropriate skills and characteristics, including business experience and personal skills in finance, marketing, business and other areas that are necessary to contribute to an effective Board of Directors and who meet the criteria set forth in Rand’s Corporate Governance Guidelines. We identify new Director candidates from prominent business persons and professionals in the communities Rand serves or who have a shared interest in the types of investments in which Rand transacts. We consider nominees of shareholders in the same manner as other nominees.

If a vacancy occurs on the Board of Directors, or if the size of the Board of Directors is changed, the Governance and Nominating Committee may, in compliance with the requirements of the Shareholder Agreement described below, recommend candidates to the Board of Directors for election. The Board of Directors may elect a new Director to fill any unexpired term of the seat. Annually, the Governance and Nominating Committee will recommend a slate of new and/or continuing candidates for nomination for election to the Board of Directors. The Board of Directors will select a slate of nominees for Director from recommendations of the Governance and Nominating Committee, and submit the slate of nominees to be voted on by shareholders at Rand’s next annual meeting of shareholders. Rand’s by-laws provide that an annual meeting of shareholders shall be held on the date that the Board of Directors shall determine. The number of Directors on the Board is determined by the Board of Directors, but in no event may it be less than three Directors.

| Proxy 14 |

Pursuant to the terms of the Shareholder Agreement, East has the right to designate two or three persons, depending upon the size of the Board of Directors, for nomination for election to the Board of Directors. East will have the right to designate (i) up to two persons if the size of the Board of Directors is composed of fewer than seven directors or (ii) up to three persons if the size of the Board of Directors is composed of seven or more directors. East’s right to designate persons for nomination for election to the Board of Directors under the Shareholder Agreement is the exclusive means by which East may designate or nominate persons for election to the Board of Directors. Given the Board of Directors currently consists of five Directors, East has the right to designate up to two persons for nomination for election to the Board of Directors. In connection with the Annual Meeting, Messrs. Gusky and Godley were each designated for nomination for election to the Board of Directors by East pursuant to the terms of the Shareholder Agreement.

Criteria and Diversity

In considering whether to recommend any candidate for inclusion in the Board’s slate of recommended director nominees, including candidates recommended by shareholders, the Governance and Nominating Committee will apply the criteria set forth in Rand’s Corporate Governance Guidelines. These criteria include the candidate’s professional experience, business skill set and the ability to act in the interests of all shareholders. Our Corporate Governance Guidelines specify that the value of diversity on the Board should be considered by the Governance and Nominating Committee in the director identification and nomination process. The Board generally conceptualizes diversity expansively to include, without limitation, concepts such as race, gender, national origin, differences of viewpoint, education, skill and other qualities that contribute to the Board when identifying and recommending director nominees. The Governance and Nominating Committee seeks nominees with a broad diversity of experience, professions, skills, and backgrounds. The Governance and Nominating Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. Rand believes that the backgrounds and qualifications of the Directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities.

Code of Conduct and Business Ethics

Rand has adopted a written Code of Conduct that applies to Rand’s Chief Executive Officer and Chief Financial Officer that meets the requirements of Item 406 of Regulation S-K. Rand will disclose any substantive amendments to, or waiver from provisions of, the Code of Conduct made with respect to the Chief Executive Officer and the Chief Financial Officer on its website.

In addition, the Corporation has adopted a Board of Directors (Non-Interested) Business Ethics Policy Statement that is applicable to Rand’s Independent Directors. This Business Ethics Policy Statement acts as a general statement of the Corporation’s expectations regarding the ethical standards that each Independent Director should adhere to while acting on behalf of the Corporation, including acting in good faith and in the honest belief that their actions are in the best interests of the Corporation and its shareholders.

Finally, a Joint Code of Ethics has been jointly adopted by the Corporation and RCM that is applicable to the directors, officers and employees of RCM and the officers and Directors of the Corporation that are interested persons. In addition to establishing general standards of conduct for such persons, the Joint Code of Ethics also includes additional procedures as provided by Rule 17j-1 under the 1940 Act to prevent officers and Directors of the Corporation that are interested persons from abusing their access to information about the Corporation’s investments.

The Code of Conduct, the Business Ethics Policy Statement and the Joint Code of Ethics are each available in the Governance section of Rand’s website at www.randcapital.com.They are also available in print to any shareholder who requests them.

| Proxy 15 |

Audit Committee

The Board of Directors has determined that none of the members of the Audit Committee during 2020 were “interested persons” as defined in Section 2(a)(19) of the 1940 Act. During 2020, the Audit Committee was comprised solely of Independent Directors, all of whom met the independence requirements of the Nasdaq Stock Market and the rules of the SEC during their term of service. The Board of Directors has determined that, for 2020, Robert M. Zak was an audit committee financial expert (as defined by SEC regulations). In addition, each member that served on the Audit Committee during 2020 possessed the financial qualifications required of Audit Committee members set forth in the rules and guidelines of the Nasdaq Stock Market.

The Audit Committee’s charter may be accessed at Rand’s website, www.randcapital.com. The Audit Committee reviews the scope and results of the annual audit, receives reports from Rand’s independent registered public accountants, and reports the Audit Committee’s findings and recommendations to the Board of Directors.

The Audit Committee has adopted necessary reporting procedures for the confidential submission, receipt, retention and treatment of accounting and auditing complaints.

Factors used in the Audit Committee’s Assessment of the External Auditor Qualifications and Work Quality:

The Audit Committee is responsible for the appointment, compensation and oversight of external auditors.

The Audit Committee annually reviews the Corporation’s independent registered public accounting firm’s (the “audit firm”) performance and independence in deciding whether to continue to retain such audit firm. In the course of these reviews, the Audit Committee considers, among other things:

| ● | The quality and efficiency of the audit firm’s historical and recent audit plans. | |

| ● | The audit firm’s capabilities and expertise in handling the breadth and complexity of private equity accounting, portfolio valuation and public company reporting. | |

| ● | The desired balance of the audit firm’s experience and fresh perspective occasioned by mandatory audit partner rotation every five years, and the audit firm’s periodic rotation of other audit management. | |

| ● | Public Company Accounting Oversight Board (PCAOB) reports on the audit firm, if any. | |

| ● | The appropriateness of the audit firm’s fees, which the Audit Committee evaluates, reviews and approves. | |

| ● | The effectiveness of the audit firm’s communications and working relationships with the Audit Committee and the Corporation’s officers. | |

| ● | The audit firm’s independence and objectivity. | |

| ● | The audit firm’s tenure, having served as the Corporation’s independent registered public accounting firm since 2003. | |

| ● | Evaluation of the audit by our executive officers and the Audit Committee. |

The Audit Committee considers non-audit fees and services provided when assessing auditor independence.

| Proxy 16 |

Independent Registered Public Accounting Firm Fees

The aggregate fees for each of the last two fiscal years for services rendered by Freed Maxick CPAs, P.C. (“Freed”) are as follows:

| Fee Description | 2020 | 2019 | ||||||

| Audit | $ | 141,900 | $ | 115,500 | ||||

| Audit Related | $ | 0 | $ | 0 | ||||

| Tax | $ | 44,144 | $ | 75,935 | ||||

| All Other | $ | 0 | $ | 0 | ||||

For fiscal years 2020 and 2019, all of the services of Freed described in the above categories were pre-approved by the Audit Committee.

Audit Fees

This category consists of fees for the audit of annual consolidated financial statements, review of consolidated financial statements included in quarterly reports on Form 10-Q and services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or audit engagements for those fiscal years.

Audit Related Fees

This category consists of assurance and related services by the independent registered public accounting firm that are reasonably related to the performance of the audit and review of consolidated financial statements and are not reported under audit fees.

Tax Fees

This category consists of professional services rendered by the independent registered public accounting firm for tax compliance and tax planning. The services for the fees disclosed under this category include tax return preparation and technical advice provided by Freed. With respect to 2020 and 2019, this also includes technical advice provided by Freed in connection with Corporation’s intention to become a regulated investment company beginning with the 2020 tax year.

All Other Fees

This category consists of fees not covered by Audit Fees, Audit Related Fees and Tax Fees.

Estimates of annual audit, quarterly review and tax fees to be paid during the year are submitted annually to the Audit Committee for its review and pre-approval and then budgeted for by Rand. All other non-audit services must be pre-approved by the Audit Committee prior to engagement, as required by the Audit Committee’s charter.

| Proxy 17 |

Audit Committee Report

The Audit Committee has reviewed and discussed Rand’s audited consolidated financial statements with management. In addition, the Audit Committee has discussed with Rand’s independent registered public accountants, Freed Maxick CPAs, P.C., the matters required to be discussed by applicable requirements of the Public Company Accounting Oversight Board and the SEC.

The Audit Committee has received the written disclosures and the letter from Freed Maxick CPAs, P.C. required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence.

Based on the Audit Committee’s review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in Rand’s Annual Report on Form 10-K for the year ended December 31, 2020 for filing with the SEC.

This report is respectfully submitted by the Audit Committee of the Board of Directors.

Robert M. Zak, Chair

Benjamin E. Godley

Erland E. Kailbourne

The information provided in the preceding Audit Committee Report will not be deemed to be “soliciting material” or “filed” with the SEC or subject to Regulation 14A or 14C, or to the liabilities of Section 18 of the Exchange Act, unless in the future the Corporation specifically requests that the information be treated as soliciting material or specifically incorporates it by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

| Proxy 18 |

EXECUTIVE COMPENSATION

Compensation of Executive Officers

Following the Externalization in November 2019, all of the Corporation’s employees, including its executive officers, became employees of RCM. As a result, the Corporation does not currently have any employees and does not expect to have any employees in the future. Services necessary for the Corporation’s business are provided by individuals who are employees of RCM, pursuant to the terms of the New Advisory Agreement and the New Administration Agreement. Each of the Corporation’s executive officers is an employee of RCM. All of the Corporation’s day-to-day investment operations are managed by RCM. In addition, all of the services necessary for the origination and administration of the Corporation’s investment portfolio are provided by investment professionals employed by RCM.

None of executive officers receive any direct compensation from the Corporation. The compensation of RCM’s investment professionals is paid directly by RCM. However, the Corporation reimburses RCM for the Corporation’s allocable portion of expenses incurred by RCM in performing administrative obligations and functions for the Corporation under the New Administration Agreement.

Anti-Hedging Policy

As part of the Corporation’s insider trading policy, the Corporation’s directors and officers are prohibited from engaging (i) in any short sales of the Corporation’s securities, (ii) in any transaction involving puts, calls and other derivative instruments that relate to or involve the Corporation’s securities or (iii) in any hedging or other monetization transactions or similar arrangements involving the Corporation’s securities.

Director Compensation

During 2020, each Board member received a $25,000 per annum fee for Board and Committee service. Committee Chairs received an additional fee of $2,500 (Audit) or $1,000 (Governance and Nominating). The Board Chair received an additional $10,000 fee. No other forms of compensation are utilized; however, Rand reimburses out-of-town Directors for travel and out-of-pocket expenses incurred in connection with their service on our Board.

After a review of market data regarding director compensation by the Governance and Nominating Committee, effective as of January 1, 2021, upon recommendation of the Governance and Nominating Committee, the full Board approved an increase in the annual fee for Board and Committee service by $10,000 from $25,000 per annum to $35,000 per annum. We believe that this adjustment more fairly compensates our non-employee Directors for their level of activity and effort and better positions the Corporation to attract and retain non-employee Directors, all of which we believe is in the best interest of our shareholders. In connection with the foregoing, the additional fees provided for Committee Chair service ($2,500 per annum for Audit Committee chair service and $1,000 per annum for Nominating and Governance Committee chair service) and Board Chair service ($10,000 per annum) were left unchanged as compared to those additional fees paid for 2020. The Corporation does not pay meeting attendance fees.

The following table sets forth information with respect to the compensation paid to or earned by each non-employee Director for 2020. Rand did not pay or accrue any other compensation to Directors for 2020. The Corporation does not maintain a stock or option plan, non-equity incentive plan, or pension plan for our Directors.

| Name | Fees Earned or Paid in Cash | |||

| Erland E. Kailbourne | $ | 35,000 | ||

| Benjamin E. Godley | $ | 26,000 | ||

| Adam S. Gusky | $ | 25,000 | ||

| Robert M. Zak | $ | 27,500 | ||

| Proxy 19 |

Related Person Transactions

For the year ended December 31, 2020, except as described below, there were no transactions, or proposed transactions, exceeding $120,000 in which the Corporation was or is a participant in which any related person had or will have a direct or indirect material interest.

On November 8, 2019, the Corporation entered into the Prior Advisory Agreement and the Prior Administration Agreement with RCM whereby RCM agreed to provide investment advisory and management services to the Corporation. RCM is a registered investment adviser under the Investment Advisers Act of 1940, as amended, and, during calendar year 2020, was majority owned by East, which as of the Record Date owned approximately 64% of our outstanding shares, and an entity that is owned by Brian Collins. In addition, Messrs. Grum and Penberthy are each officers and employees of RCM. Effective as of December 31, 2020, the Prior Advisory Agreement and Prior Administration Agreements were terminated and replaced with the New Advisory Agreement and New Administration Agreement. Pursuant to the terms of these agreements, the Corporation’s day-to-day investment operations are managed by RCM and services necessary for its business, including the origination and administration of its investment portfolio are provided by individuals who are employees of RCM. As described in greater detail in the Corporation’s Annual Report on Form 10-K under Part I, Item 1 “Business ‒ Investment Advisory and Management Agreement,” the compensation paid by the Corporation to RCM for providing investment advisory and management services under both the New and Prior Advisory Agreements consist of two components — (i) a base management fee and (ii) an incentive fee consisting of two parts: (A) an income based fee and (B) a capital gain based fee. The Corporation reimburses RCM for the allocable portion of expenses incurred by RCM in performing obligations on behalf of the Corporation under the Administration Agreement. For the year ended December 31, 2020, the base management fee earned by RCM under the terms of the Prior Advisory Agreement was $589,519, no incentive fees were earned by RCM under the Prior Advisory Agreement and the Corporation reimbursed RCM in the amount of $22,053 for expenses incurred under the terms of the Prior Administration Agreement. In addition, for the year ended December 31, 2020, RCM reimbursed the Corporation in the amount of $7,400 for expenses incurred by the Corporation on behalf of RCM.

In order to ensure that the Corporation does not engage in any related-party transactions with any persons affiliated with the Corporation, the Corporation requires that the Audit Committee must review in advance any “related-party” transaction, or series of similar transactions, to which the Corporation or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000 and in which such related party had, or will have, a direct or indirect material interest.

Directors’ and Officer’s Liability Insurance

Rand has an insurance policy from Marsh USA effective from March 31, 2020 to March 31, 2021 that indemnifies (1) Rand for any obligation incurred as a result of its indemnification of its Directors and officers under the provisions of the BCL and Rand’s by-laws, and (2) Rand’s Directors and officers as permitted under the BCL and Rand’s by-laws. The policy covers all Directors and officers of Rand from March 31, 2020 to March 31, 2021 for a total premium of $37,000. No sums have been paid to Rand or its Directors or officers under the insurance contract.

| Proxy 20 |

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has selected Freed Maxick CPAs, P.C. (“Freed”), independent registered public accounting firm, as our auditors for the year ending December 31, 2021. While the Audit Committee is responsible for the appointment, compensation, retention, termination and oversight of our independent registered public accounting firm, our Board of Directors believes, as a matter of good governance, that it is advisable to give shareholders an opportunity to ratify this selection. If this proposal is not approved by our shareholders at the Annual Meeting, our Audit Committee may reconsider its selection of Freed. Even if the selection is ratified by our shareholders, our Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of the Corporation and our shareholders.

Representatives of Freed are expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from shareholders.

Our Board of Directors recommends that you vote “FOR” the ratification of the selection of Freed as our independent registered public accounting firm for the 2021 fiscal year.

OTHER BUSINESS

Rand does not know of any other matters that will come before the Annual Meeting. If any other matters properly come before the Annual Meeting, it is the intention of the persons designated as proxies to vote in accordance with their best judgment on such matters.

STOCK REPURCHASES

In accordance with Section 23(c)(1) under the 1940 Act, the Corporation hereby advises you that it may repurchase shares of its common stock from time to time.

| Proxy 21 |

Shareholder Proposals for the 2022 Annual Meeting

Shareholder proposals intended to be presented at the 2022 Annual Meeting of Shareholders and to be considered for inclusion in Rand’s proxy statement and form of proxy for that meeting must be received at Rand’s offices not later than November 17, 2021.

The Corporation’s by-laws provide that no business may be brought before an annual meeting of shareholders unless it is specified in the notice of the meeting or is otherwise brought before the meeting by the Board of Directors or by a shareholder entitled to vote who has delivered notice to the Corporation (containing the information specified in the Corporation’s by-laws) not later than 90 days nor more than 120 days in advance of the anniversary date of the prior year’s annual meeting of shareholders. These requirements are separate from and in addition to the SEC’s requirements that a shareholder must meet in order to have a shareholder proposal included in the Corporation’s proxy statement. A shareholder wishing to submit a proposal for consideration at the 2022 Annual Meeting of Shareholders, which is not submitted for inclusion in the proxy statement, should do so between December 23, 2021 and January 22, 2022.

In addition, under the Corporation’s by-laws, nominations for director may be made only by the Board of Directors, by the Governance and Nominating Committee, or by a shareholder entitled to vote who has delivered written notice to the Corporation (containing the information specified in the Corporation’s by-laws) not later than 90 days nor more than 120 days in advance of the anniversary date of the prior year’s annual meeting of shareholders (i.e. between December 23, 2021 and January 22, 2022), except, in the event that the annual meeting is called for a date that is not within 30 days before or after such anniversary date of the prior year’s annual meeting of shareholders, notice by the shareholder must be so received not later than the close of business on the tenth day following the day on which notice of the date of the annual meeting was mailed or public disclosure of the date of the annual meeting was made, whichever first occurs.

| March 17, 2021 | By Order of the Board of Directors |

| Erland E. Kailbourne | |

| Board Chair of the Board |

It is important that proxies be returned promptly. Shareholders are urged to complete, sign, date and return the proxy in the enclosed envelope, to which no postage need be affixed if mailed in the United States. If you attend the Annual Meeting in person you may, if you wish, withdraw your proxy and vote in person.

| Proxy 22 |

Multiple Copies of our Annual Report and Proxy Statement (Householding)

When more than one holder of Rand common stock shares the same address, we may deliver only one annual report and one proxy statement to that address unless we have received contrary instructions from one or more of those shareholders. Similarly, brokers and other intermediaries holding shares of Rand common stock in “street name” for more than one beneficial owner with the same address may deliver only one annual report and one proxy statement to that address if they have received consent from the beneficial owners of the stock.

Rand will deliver promptly upon written or oral request a separate copy of the annual report and proxy statement to any shareholder, including a beneficial owner of stock held in “street name”, at a shared address to which a single copy of either of those documents was delivered. To receive additional copies of our annual report and proxy statement, you may call or write Elspeth A. Donaldson, Office Manager, Rand Capital Management LLC, 14 Lafayette Square, Suite 1405, Buffalo, New York 14203, telephone (716) 853-0802 or email her at eadonaldson@randcapital.com. You may also access a copy of Rand’s annual report and proxy statement on our website, www.randcapital.com, or via the SEC’s EDGAR home page, www.sec.gov/edgar/searchedgar/companysearch.html.

You may also contact Miss Donaldson at the address or telephone number above if you are a shareholder of record of Rand and you wish to receive a separate annual report and proxy statement in the future, or if you are currently receiving multiple copies of our annual report and proxy statement and want to request delivery of a single copy in the future. If your shares are held in “street name” and you want to increase or decrease the number of copies of our annual report and proxy statement delivered to your household in the future, you should contact the broker or other intermediary who holds the shares on your behalf.

FINANCIAL STATEMENTS AVAILABLE

A copy of Rand’s 2020 annual report containing audited financial statements accompanies this Proxy Statement.

Rand will provide without charge to each shareholder upon written request a copy (without exhibits, unless otherwise requested) of Rand’s Annual Report on Form 10-K required to be filed with the SEC for the year ended December 31, 2020. Requests for copies should be addressed to Investor Relations, Rand Capital Corporation, 14 Lafayette Square, Suite 1405, Buffalo, New York, 14203. Requests may also be directed to (716) 853-0802 or to eadonaldson@randcapital.com via email. Copies may also be accessed electronically by means of the SEC’s EDGAR home page on the internet at http://www.sec.gov/edgar/searchedgar/companysearch.html.

FINAL PAGE OF PROXY STATEMENT

| Proxy 23 |